Understanding the Cost of Capital for Startups: What You Need to Know

As a startup founder, one of the most critical decisions you will make is how to finance your business. Whether you’re raising funds from investors or taking out a loan, the “Cost of Capital” is a fundamental concept you need to understand to make informed financial decisions and ensure the long-term sustainability of your venture.

In this article, we will break down what the cost of capital is, why it matters for startups, and how to calculate it to guide your funding strategy.

What is the Cost of Capital?

The cost of capital is essentially the price a company pays to raise funds. It represents the return that investors expect to receive in exchange for providing capital to your business. This cost can arise from two main sources:

- Debt Capital (borrowed money)

- Equity Capital (money raised from selling shares)

These sources of funds have different costs associated with them. Debt capital requires repayment with interest, while equity capital involves giving up a portion of your company’s ownership. Both affect your business in different ways, and understanding their costs is key to making smart financial decisions.

Debt vs. Equity: What’s the Difference?

Before diving into the calculation of the cost of capital, it’s crucial to understand the differences between debt and equity, as these are the two primary methods of financing a startup.

- Debt Capital: This refers to loans or other forms of borrowing where the company must repay the principal amount along with interest. The cost of debt is essentially the interest rate a company pays on its loans.Pros: Debt financing doesn’t dilute ownership. The interest payments on the debt are tax-deductible, which can lower the actual cost.Cons: Debt must be repaid, often with interest, regardless of the company’s performance, increasing financial risk.

- Equity Capital: This is money raised by selling shares of the company. Investors provide capital in exchange for ownership stakes, and they expect a return based on the company’s future growth.Pros: No obligation to repay the investors, so there’s less immediate financial pressure.Cons: You give up partial control of your company, and future profits will need to be shared.

How to Calculate the Cost of Capital

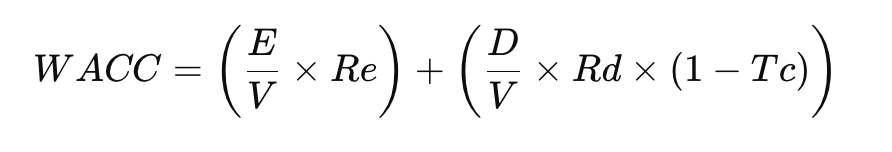

A widely accepted way to calculate the cost of capital is by using the Weighted Average Cost of Capital (WACC). WACC combines both the cost of debt and the cost of equity to give you a clearer picture of your company’s overall cost of raising funds.

WACC Formula:

Where:

- E = Market value of equity (the total value of shares)

- D = Market value of debt (the total value of loans)

- V = Total value of capital (E + D)

- Re = Cost of equity (return expected by equity investors)

- Rd = Cost of debt (interest rate on loans)

- Tc = Corporate tax rate (because interest on debt is tax-deductible)

Step-by-Step Breakdown:

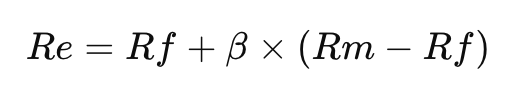

- Cost of Equity (Re): This is the return that equity investors expect. A common method to calculate this is using the Capital Asset Pricing Model (CAPM)

Where Rf is the risk-free rate (such as government bonds), β\betaβ is the volatility compared to the market, and Rm is the expected market return. - Cost of Debt (Rd): This is the effective interest rate a company pays on its debt. It is generally the average interest rate on outstanding loans or bonds.

- Proportions of Debt and Equity: The weights of debt and equity (D/V and E/V) are based on the market values of each source of capital. For example, if your company is financed 60% through equity and 40% through debt, these proportions would be reflected in the WACC calculation.

- Corporate Tax Rate (Tc): Since interest payments are tax-deductible, the effective cost of debt is reduced by the corporate tax rate.

Why is the Cost of Capital Important for Startups?

The cost of capital is crucial because it determines the minimum return your business needs to generate to satisfy its investors or pay off its debt. It serves as the “hurdle rate” for investment decisions—if your company’s return is higher than the WACC, you’re adding value; if not, you may be destroying value.

Here are three reasons why understanding your cost of capital is essential for startups:

- Informs Your Funding Strategy: Knowing the cost of debt vs. equity can help you decide the right mix of financing. Startups typically rely more on equity financing since debt can be risky in the early stages, but as you grow, balancing both becomes important.

- Helps in Valuation: Investors use the WACC to discount future cash flows and estimate the value of your business. A lower WACC implies less risk, making your startup more attractive to investors.

- Guides Growth Decisions: WACC also impacts decisions about expansions, new projects, or acquisitions. If the return on a new project exceeds the WACC, it’s generally a good investment.

How to Lower Your Cost of Capital

A lower cost of capital means your startup can achieve higher profitability and attract more investors. Here are a few strategies to reduce your WACC:

- Improve your creditworthiness: By building a solid track record and maintaining healthy cash flow, you can reduce your borrowing costs.

- Optimize capital structure: Striking the right balance between debt and equity can lower your WACC. As your startup grows, debt may become cheaper, but managing the risk of high leverage is key.

- Increase profitability: By improving operational efficiency and boosting profit margins, your business becomes more appealing to equity investors, reducing the expected return.

Conclusion

Understanding and calculating your startup’s cost of capital is essential for making informed financial decisions. By optimizing your capital structure and maintaining a balance between debt and equity, you can lower your WACC, making your business more efficient and attractive to investors.

Keep an eye on your cost of capital as you grow, and be prepared to make adjustments to your funding strategy to ensure long-term sustainability.

Looking for more insights into startup finance? Follow Sativa Ventures for expert tips and resources to help you on your entrepreneurial journey!